How to fill out a property tax return? What does a sample of filling out a property tax return look like? Form of a property tax return.

In this article you will find the answer to the question of how to fill out a property tax return. You can also see a sample of filling out the declaration and download the property tax declaration form itself.

The declaration is submitted at the end of the tax period until March 30. If a constituent entity of the Russian Federation has reporting periods, then the tax return, together with the calculation of advance payments, must be submitted at the end of each reporting period (by April 30, by July 30, by October 30).

Rules for filling out a property tax return

When filling out any declaration, you need to remember the following rules:

- use a fresh, up-to-date declaration form (there are frequent updates, some lines are added, some are removed, you need to keep track of this);

- all amounts are written in full rubles, kopecks are rounded;

- if the declaration is filled out manually, write all letters and numbers large and clearly;

- dashes are placed in empty cells of both filled and empty lines;

- the declaration can be completed on a computer or manually, submitted to the tax office in person, sent by mail, or electronically;

- be guided when filling out the Procedure for filling out a tax return for property tax of organizations - an official document that explains in detail the design of each page and each line of the declaration. At the end of the article you can download this document along with the declaration form itself.

Sample of filling out a declaration on property tax of organizations

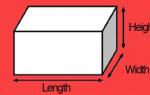

The document form consists of a title page and three sections.

Section 3 is filled out by foreign organizations that do not have a permanent representative office in the Russian Federation; they also fill out the title page and section 1.

All other organizations, including foreign ones, fill out only the title page and the first two sections.

Let us give an example of preparing a property tax return for the organization Confectioner LLC, which submits reports for 2012, that is, for the tax period. Moreover, Confectioner LLC paid quarterly advance payments throughout 2012.

The title page of the declaration is standard and contains general information about the taxpayer and the reporting period.

- At the top is the TIN/KPP of the organization.

- “Adjustment number” – if we are reporting for the first time – “0”, if the declaration was subsequently adjusted, then, accordingly, “1”, “2”, etc.

- “Tax period” – “34” corresponds to the calendar year.

- Next, we indicate the reporting year, tax number and accounting code, which is taken from Appendix No. 3 to the Filling Out Procedure.

- Next we write the name of the organization, its activity code OKVED.

- If there was a reorganization, then fill out the lines “reorganization form” (from Appendix No. 2) and the TIN/KPP of the reorganized organization.

We also indicate in the “I confirm the accuracy” block the full name of the taxpayer. If the property tax return is submitted by a representative, then fill in the name of the representative organization and a document confirming the right to sign.

Filling out a corporate property tax return. Section 2

The next step when filling out the declaration is to fill out the second section. This section goes directly.

At the top of the sheet we indicate the code of the type of property (taken from Appendix No. 5 to the Filling Out Procedure) and the OKATO code.

In lines 020 - 140, in the “total” column, the total residual value of the property is indicated on the first day of each month and on the last day of the year. You can see how to determine this residual value. The column “including the value of privileged property” is filled in if the taxpayer has property that falls under the benefit, that is, is not taxed.

Line 141 indicates data on real estate at the end of the year.

In line 150 we write the average annual value of the property, which we define as the sum of lines 020-140 in the “total” column, divided by 13.

Line 160 “benefit code” consists of two parts, the first part (before the separator) is filled out on the basis of Appendix No. 6 to the Filling Out Procedure, if the organization has such property. The second part is only for benefit code 2012000, that is, for benefits provided by the constituent entities of the Russian Federation.

In line 170 we write the average annual value of the property eligible for the benefit. It is calculated as the sum of lines 020-140 of the column “including...”, divided by 13.

Line 180 is filled in only for property code - 2.

In line 190 we write the tax base equal to the difference between lines 150 and 170. If the property code is 2 at the top, then this difference must be multiplied by another line 180.

Line 200 is filled in if the property is subject to reduced rates established by the constituent entities of the Russian Federation, the corresponding benefit code according to Appendix No. 6 is 2012400, and the number of the article of the law on the basis of which the reduced rate is applied is written through a fraction.

Line 210 - write the tax rate.

Line 220 is the tax amount itself, calculated as the product of lines 190 and 210, divided by 100.

Line 230 is completed only by organizations that pay quarterly advance payments.

Based on the data in Section 2 (or 3 for foreign organizations that do not have a permanent representative office in the Russian Federation), we draw up Section 1.

In line 010 we indicate the OKATO code, in line 020 - the budget classification code.

If the difference between lines 220 and 230 of section 2 (that is, the difference between the amount of tax and quarterly payments paid) is greater than 0, then this difference should be paid additionally to the budget; we indicate this difference in line 030.

If the difference between lines 220 and 230 gives a negative result, then fill in line 040.

Property tax – one of the main articles income to the state budget. The tax authorities of the Russian Federation collect deductions under the Tax Code of the Russian Federation from property owned by individuals and legal entities.

It is worth noting that not all objects are subject to taxation. To do this, they must be classified by tax legislation as belonging to fixed assets or profitable investments in material assets.

In fact, the main types of property are real estate, but movable property (in some cases) is also subject to taxation. Mandatory types of objects for which the Federal Tax Service authorities will require deductions on the basis of the Tax Code of the Russian Federation are:

- Received under a concession agreement. This is a procedure that provides for the transfer of ownership of something to persons or organizations who undertake responsibilities for the restoration and reconstruction of the object.

- To be transferred into temporary possession or already transferred under this procedure. This also includes trust use, disposal of an object and joint activities on the territory of the Russian Federation or abroad.

- Objects purchased and used abroad.

As for real estate subject to tax: it includes both buildings and structures. In fact, the legislator defined in this category all objects, the transfer of which without damage to them (structures) is impossible.

Property tax on construction projects (not put into operation) and land plots, in accordance with the Tax Code of the Russian Federation, is not paid. Taxation of land occurs according to a separate procedure, and unfinished structures and buildings are not considered property by law.

By the way, residential premises can also fall into this category. This is possible in a situation where a legal entity or organization purchases a house/apartment for further sale. In this case, in the declaration this object will be listed in column 41 “Goods”.

The main value for calculating deductions in this case is cadastral value, and regional/local laws must approve the inclusion of residential premises acquired by organizations as subject to taxation. But if such laws have not been adopted at the regional (regional) level, then objects of this type are not included in the declaration.

Summarizing the above, taxes are imposed on:

- Fixed assets. They are any objects with a useful life of more than one year, intended for use in production or management. The property may not be for sale and may have the potential to generate income in the future. This also includes rental properties. These include: working machines, industrial and other equipment, instruments and devices, transport, computing devices, household equipment, environmental management facilities, expenses for radical improvement of land plots (the so-called “capital investments”).

- Residential premises and houses.

Exceptions and benefits

There are a number of exceptions to the rules. Clause 4 of Art. 374 of the Tax Code of the Russian Federation regulates the list of objects that are not taxed. The legislator includes:

The Tax Code of the Russian Federation provides for a number of tax benefits in Article 381 of the Tax Code of the Russian Federation. In addition to the conditions created for the development of sectors of the economy and social spheres, this part of the law makes it possible to reduce contributions to almost any organization whose balance sheet contains movable property, unless it became the property of the company as a result of the liquidation of another legal entity or a transaction between persons conducting joint activities. It is also impossible to do this if standard company reorganization(for example, from a closed joint stock company to an LLC).

Also included in the preferential category is property acquired through an intermediary who is not an interdependent person in relation to the organization.

Instructions for filling

In order to fill out a property tax return using the current form approved by the current Tax Code of the Russian Federation, you must first provide correct information about the company. You can find them in the constituent documents issued when registering an organization or company as a taxpayer.

Sections of the document are not completed in the order in which they appear in the template. First, you should start entering information into the third (last) section, and only then into the second and, finally, the first.

Third section must be issued for each individual piece of property listed in section 1 of the article. In this case, the tax rate is multiplied by the estimated cadastral value of the property. Each of them is described on a separate sheet.

Each of the pages of the third section is designed identically and contains a small amount of data about real estate objects:

- OKMTO code;

- cadastral number;

- cadastral value;

- tax-free share of the cadastral value;

- tax benefit code (if any);

- tax rate;

- amounts of tax and advance payments for the reporting period.

It is also worth noting that the third page contains important information related to the first section: TIN and KPP of the company or person.

In second section On separate sheets it is worth describing only those taxation objects that have different OKTMO codes. Recently, on the Federal Tax Service website www.nalog.ru you can easily find information on the compliance of OKTMO and OKATO.

OKTMO consists of a couple of sections that relate to local education and directly to the locality where the taxable object is located. The first section consists of 8 characters. In the second section - 11 characters, which identify the municipality and settlement.

It is in the second section that additional information is indicated on the tax benefits that are provided for the organization under the Tax Code of the Russian Federation and are described in the first section of the article. All objects for which the tax rate has been reduced in accordance with the law are separately indicated here.

The second section also includes codes of movable and immovable property, taxable (subject to the nuances described above). Also indicated:

- average annual value of property for the reporting period;

- tax benefit codes (if any);

- average annual total value of non-taxable property (if any);

- tax base;

- tax rate;

- tax amount (from section 1);

- volume of advance payments;

- residual value of fixed assets as of the end of the calendar year;

- TIN and KPP of a legal entity.

First section reflects the final data on the amount of payment to the Federal Tax Service based on the results of the reporting period. Information is provided here:

- correction number;

- tax period;

- reporting year;

- location of the tax authority;

- individual number of the territorial branch of the Federal Tax Service;

- company name (full);

- code of type of economic activity (OKVED);

- contact phone number;

- the name of the person confirming the truthfulness and completeness of the information specified in the declaration;

- signature;

- date of document preparation.

Possible nuances

The third section indicates objects for which payments are calculated based on their cadastral value. These include:

- residential premises that are not on the balance sheet of the organization’s fixed assets;

- real estate of foreign companies that do not have permanent representative offices on the territory of the Russian Federation;

- non-residential real estate: offices, catering establishments, retail outlets and others;

- shopping centers, as well as administrative and business buildings.

In the event that objects from the list were added to the company’s balance sheet during the reporting period, the calculated coefficient. It is calculated from the duration of ownership of the object (in months) and divided by 12 (the number of months of the calendar year). If the transfer of property occurred later than the 15th day, then the month is considered full when calculating.

In a situation where the cadastral list of real estate has been changed in a constituent entity of the Russian Federation, an object that was in the third section in the declaration for last year is transferred to the second (or vice versa).

The choice of the Federal Tax Service to which the property tax return should be submitted deserves special attention. Only the branch of the Federal Tax Service to which the organization reports can act as such. Such data is provided on the official website of the structure via the link. In the event that the company’s balance sheet includes objects that belong to separate divisions of the company, the declaration is sent to the branch where it was registered.

As for real estate, tax returns are authorized to be accepted only by the branch of the Federal Tax Service that geographically serves the region or locality where the property is located. Data on accredited branches of the Federal Tax Service can be obtained from the link given in the paragraph above. Filing a declaration to only one branch of the Federal Tax Service is possible only if all the property is located at the head office of the company.

Terms and periods

All companies recognized as property owners are required to pay tax and independently prepare/submit reports to the territorial authorities of the Federal Tax Service. In 2018-2019 the deadlines are as follows:

- for 2018 - until March 29;

- for the first quarter of 2019 - until April 30;

- for the first half of 2019 - until July 31;

- for 9 months of 2019 - until October 31.

Also, it is within the competence of a subject of the Russian Federation to make a decision on exemption from submitting interim reports. But this does not apply to the final annual declaration - the obligation to submit it to the Federal Tax Service is enshrined in the Tax Code of the Russian Federation at the federal level for all organizations and individuals without exception.

Tax calculations are submitted for several periods:

- from January to March;

- from January to June;

- from January to September.

At the end of the year it is produced preparation and submission of a declaration. Its creation is mandatory for all individuals and organizations that have fixed assets on their balance sheet.

The property declaration for 2018 must be submitted before the last day of March, which is prescribed in Article 386 of the Tax Code of the Russian Federation.

It is worth noting that filing a declaration electronically is also provided for by the legislator, but only for companies with an average annual number of employees over 100 people.

Responsibility measures

The legislator provides for punishment only for late submission of a declaration for the reporting period (calendar year). According to Article 119 of the Tax Code of the Russian Federation, one cannot be held accountable for being late in submitting tax calculations for a quarter, half a year or 9 months. But for late filing of a declaration there are two types of liability:

- Tax. The fine is 200 rubles (Article 126 of the Tax Code of the Russian Federation).

- Administrative. A fine for an official or founder in the amount of 300 to 500 rubles in accordance with Article 15.6 of the Code of Administrative Offenses of the Russian Federation.

It is worth noting that you can only be fined for non-payment or incomplete payment of property taxes. Advance payments, regardless of their size, are not subject to such sanctions. The fine is calculated in accordance with the amount that the taxpayer was required to transfer by the end of March (the deadline for filing the declaration) - it is indicated in column 030 and should be equal to the difference in the indicators in columns 220 and 230 of the second section.

If the condition is not met, the territorially authorized branch of the Federal Tax Service will request more accurate data on all points and make a decision based on the official response of the organization’s representative.

Failure to pay taxes may result in both administrative and criminal liability. The fine for violation is 20% from the amount indicated in the declaration. If circumstances indicate deliberate evasion, the rate increases to 40% .

Organizational property tax is calculated and paid only by organizations that have property recognized as an object of taxation. Moreover, the residence of the property owner is not important. In other words, if a foreign organization has property on the territory of Russia that is recognized as an object of taxation, then it is also recognized as a tax payer.

Depending on what tax system the organization uses, the need to pay property tax should be determined.

If an organization applies a general taxation system, then it is recognized as a taxpayer if there are objects of taxation. Moreover, the company is recognized as the payer regardless of whether the benefit and (or) exemption on property is used or not.

But if an organization applies the simplified tax system or UTII, then it is recognized as a payer only if the company has an object for which the tax base is the cadastral value.

Who must report on the organization’s property tax?

All taxpayers must report corporate property taxes.

The declaration must be submitted based on the results of the tax period - the calendar year. During the same year, organizations submit calculations of advance payments for property taxes.

Entrepreneurs and citizens without merchant status are not required to report on the organization’s property tax at all.

By the way, if an organization does not have fixed assets, for example, leased assets, then it is not necessary to report taxes. After all, the business entity in this case is not a tax payer.

Place of submission of land tax declaration

The procedure for submitting an organization’s property tax declaration depends on many factors: the type of property (movable, immovable), the presence of a separate division, and the determination of the balance holder. For example, if movable property is on the balance sheet of the parent organization, but is used by a division without a separate balance sheet, then the declaration is submitted at the location of the organization itself (parent organization).

And if, for example, an organization has an object for which the base is calculated based on the cadastral value, then the declaration is submitted at the actual location of the property.

Deadline and method for submitting the declaration

Early submission of the declaration is possible, but only if in the current period the organization liquidates, writes off or sells all fixed assets.

The property tax declaration can be submitted to the inspectors:

- in paper form;

- via electronic communication channels. If the average number of employees exceeds 100 people, then the declaration should be submitted only electronically. The same delivery method is used by the largest taxpayers.

For error-free preparation and timely submission of an organization’s property tax return [and other reports], use the “My Business” online service. The service automatically generates reports, checks them and sends them electronically. You will not need to personally visit the tax office, which will undoubtedly save not only time, but also nerves. You can get free access to the service right now via this link.

The procedure for filling out an organization’s property tax return

The organization's property tax declaration consists of a title page and four sections.

We fill out the cover page of the organization’s property tax declaration

The header indicates the tax identification number and checkpoint. The checkpoint should be given special attention if there are taxable objects at the location of the unit with a separate balance sheet or the organization reports on remote real estate objects. In these cases, the exact checkpoint where the organization submits declarations is indicated.

The “Adjustment number” field should be filled in starting with the designation “0- -”. This number is assigned to the primary declaration. If an organization submits an updated declaration, then indicate the number in order of adjustment from “1--”, “2--” and onwards.

In the “Tax period (code)” field, you should indicate one of the codes specified in Appendix No. 1 to the Procedure for filling out the declaration, approved by Order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-21/271. If the declaration is submitted for the year as a whole, then code “34” should be indicated - Calendar year.

In the “Reporting year” field, you should indicate the year for which the declaration is being submitted. In our case it is “2017”.

The tax authority code is usually automatically entered into an automated accounting program. Forgot your code or had a software glitch? Then check the code on the tax website using the link.

The codes for filling out the line “At location (registration)” are specified in Appendix No. 3 to the Procedure for filling out the declaration, approved by Order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-21/271. For example, if a declaration is submitted at the location of a Russian organization that is not the largest taxpayer, then code “214” is indicated. Is your organization the largest taxpayer? Then the code for you is “213”.

In the “Taxpayer” field, you should indicate the full name of the organization in accordance with the charter.

Be sure to include a contact phone number and sign the representative of the company responsible for submitting the declaration.

An example of filling out the title page of an organization’s property tax return

Section 1 of the organization’s property tax declaration

On line 010 of section 1, the OKTMO code is indicated.

On line 020 - KBK for property tax: 182 1 06 02010 02 1000 110 - for property not included in the Unified Gas Supply System; 182 1 06 02020 02 1000 110 - for property included in the Unified Gas Supply System.

On line 030 you must indicate the amount of property tax of the organization. If the tax was reduced, then line 040 is filled in.

An example of filling out section 1 of an organization’s property tax return (fragment)

Section 2 of the organization’s property tax declaration

Section 2 of the property tax return shows the calculation of the tax, the tax base for which is the average annual value of assets.

On line 141 it is necessary to indicate the residual value of the property at the end of the year.

On line 150 you should indicate the average annual value of the property. To do this, the data from lines 020-140 from column 3 is summed up. The resulting indicator is divided by 13.

The benefits have their own codes according to Appendix No. 6 to the Procedure for filling out the declaration, approved by Order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-21/271.

Line 170 indicates the average annual value of tax-free property for the tax period, calculated as the quotient of dividing by 13 the sum of the values in column 4 lines with codes 020-140.

Line code 190 indicates the tax base.

Important point. Line 270 should reflect the cost of all fixed assets that are listed on the organization’s balance sheet as of December 31 of the reporting year. The exception is fixed assets that are not recognized as objects of taxation in accordance with subparagraphs 1-7 of paragraph 4 of Article 374 of the Tax Code of the Russian Federation. There is no need to indicate their residual value on line 270.

Section 2.1 of the organization’s property tax declaration

Section 2.1 of the declaration is completed for real estate objects, the tax base for which is the average annual cost.

Lines 010-050 indicate all the necessary information about the object.

So, line 010 indicates the cadastral number. And on line 020 the conditional number of the object (if any) from the Unified State Register of Real Estate.

On line 030 you should indicate the inventory number of the object if lines 010 and 020 are not filled in.

On line 040 you should indicate the object code according to OKOF. And on line 050 you should indicate the residual value of the object as of December 31 of the tax period.

For each object, a separate block of section 2.1 is filled in

An example of filling out section 2.1 of an organization’s property tax declaration (fragment)

Section 3 of the organization’s property tax declaration

By the way, a separate section 3 is filled out for each object.

Line 001 indicates the code of the type of property. These codes are given in Appendix No. 5 to the Procedure for filling out the declaration, approved by Order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-21/271.

On line 020 you should indicate the cadastral value of the property as of January 1 of the year. Line 025 indicates the cost, which may not be subject to tax.

Line 030 is filled in when the object is in common ownership. And line 035 indicates the share of the cadastral value that falls on the area of the premises.

Line 040 indicates the benefit.

The specifics of filling out line 050 are specified in the order of filling out the declaration. This line is completed if the property is located:

- on the territory of several regions;

- both on the lands of the subject, and in the territorial sea of the Russian Federation, on its continental shelf or in the Russian exclusive economic zone.

The base for the object is indicated on line 060.

After all the necessary information has been filled in to determine the tax base, information about the applicable property tax rate is entered in Section 3.

If an object is disposed of or received by the organization during the tax period, then these deadlines 090 are filled in. The number of full months of ownership of the objects during the tax period (12 months) is indicated here. To determine the full number of months of ownership, it is recommended to use the norm of paragraph 5 of Article 382 of the Tax Code of the Russian Federation.

The amount of the fine is 5 percent of the tax amount according to the declaration. The fine is charged for each month (full or partial) of delay. In this case, the minimum amount is 1000 rubles, and the maximum is no more than 30 percent of the tax amount.

The account may be blocked if the business entity does not submit a declaration within 10 working days after the deadline for filing it has expired. In this case, the account is blocked completely.

If an organization is required to submit a return electronically due to a legal requirement, but submits a property tax return in paper form, inspectors may impose a fine on the organization. Its size is 200 rubles. The basis is Article 119.1 of the Tax Code of the Russian Federation.

The property tax declaration is submitted as a reporting document to the Federal Tax Service only by organizations. During the year, at the end of each quarter, taxpayers are also required to submit Calculations for Advance Payments. They are submitted to the tax authorities within 30 days after the end of the reporting period. For property tax declarations, the submission frequency to the Federal Tax Service is once a year - it must be submitted by March 30 of the year following the reporting year.

New property tax return

Since 2017, a new declaration template has been in effect. It was approved by the Federal Tax Service by order dated March 31, 2017 No. ММВ-7-21/271@. The changes affected the rules for displaying the details used to identify taxable objects. Detailed recommendations for filling out the updated forms are given in letters of the Federal Tax Service dated July 3, 2017 No. BS-4-21/12769@, dated August 24, 2017 No. BS-4-21/16786@, dated September 5, 2017 No. BS -4-21/17595@.

The deadline for submitting a property tax return remains the same: for 2017, you must report no later than March 30, 2018.

The innovations are as follows:

- The columns for indicating the OKVED code are excluded from the document form.

- The list of code designations for types of property assets has expanded (their full list is given in Appendix No. 5, which is part of the Procedure for filling out a declaration from Order No. ММВ-7-21/271@).

- Now a tax return for corporate property tax can be submitted to regulatory authorities without certification with the company’s seal (if the company does not use a seal).

- In the updated report form, an additional section has appeared for object-by-object detailing of information about property from the group of real estate assets (Section 2.1). This block should show only those objects that are taxed at the average annual value.

- The current property tax declaration (the form can be downloaded below) in section 3 contains lines for entering codes for types of property and taxpayers’ shares in the rights to real estate assets. The lines for displaying cadastral value have also undergone changes.

- The list of tax benefits has become wider by 3 points (Appendix No. 6 to the Completion Procedure).

Who files a property tax return?

The declaration must be submitted by all business entities that are recognized as payers of this type of tax. The category of such persons includes enterprises that have taxable property. These can be not only domestic organizations, but also foreign companies that carry out their commercial activities in the Russian Federation through permanent representative offices.

Procedure for filling out a property tax return

To calculate the tax liability and correctly reflect information on property in the declaration, you will need information about the different types of value of property assets listed on the company’s balance sheet. The value of the cadastral valuation can be found from Rosreestr data. The accounting registers contain information about the value of property from the preferential category and the residual value of movable and immovable assets.

It is important that the 2017 property tax return be prepared on an updated form. All amounts are entered rounded to the nearest ruble. Continuous page numbering begins with the Title Page. Corrections in the document are not allowed, and double-sided printing is prohibited.

- the Title Page contains information about the taxpayer;

- in line 150 of section 1, the value of the average annual value of property assets for the tax period in question is entered;

- in line 210 of the property tax declaration, section 1 indicates the tax rate that is applied to the corresponding type of property for this category of taxpayers (if there are benefits, the rate is shown taking into account reducing values);

- Section 2 is completed separately by type of property, its location and tax rates applied to it;

- in section 2, line 230 of the property tax declaration is needed to reflect the amount of calculated advance payments reflected in previously submitted advance tax calculations. If on line 001 of section 2 “Property type code” the code is 04 or 07, in line 230 we indicate “0”;

- in section 2.1, the designation of the inventory number is entered in line 030 if the object does not have a cadastral or conditional number.

Each organization that owns property, along with individuals, automatically becomes a payer of corporate property tax. Let's consider who should transfer this budget payment to the treasury, as well as what the 2018 corporate property tax declaration is.

Organizational property tax: who submits the declaration

If a legal entity owns movable or immovable property, the company is obligated to pay corporate property tax to the budget. The main document regulating its payment is the Tax Code of the Russian Federation.

In accordance with the requirements of the law, the category of real estate includes all real estate, with the exception of land plots and other similar environmental management facilities.

Depending on which tax regime the payer applies, the object of taxation will also change.

Let's consider in what cases a company on OSNO becomes a payer of this tax.

In the event that a company operates under the general regime and is the owner of movable and immovable property, it must remit tax if:

- Real estate is on the company's balance sheet as an object of fixed assets;

- The property includes residential real estate that is not included in the company's organized accounting records;

- The organization is the owner of movable property (only for OSNO):

- The fixed assets object was accepted for accounting until 01/01/13;

- An object of fixed assets was accepted for accounting as a result of the liquidation of a company or its reorganization after 01/01/13;

- The property came to the company as a result of transfer from a related party after 01/01/13.

In accordance with the provisions of Art. 374 of the Tax Code of the Russian Federation, if a company on a general basis owns movable property belonging to the first and second depreciation groups, that is, with a service life of one to three years, there is no need to calculate and transfer tax to the budget.

In order to determine the amount to be paid, you should know how the tax base is calculated. For corporate property tax, the tax base is determined as the average annual value of the property that is the object of taxation.

The tax period for this tax is equal to one calendar year, regardless of what category of property the company owns.

Companies determine the deadline for paying taxes to the budget based on the provisions of regional legislation. In most cases, it is assumed that the budget payment will be transferred to the treasury after the first quarter of the year following the end of the tax period.

Organizational property tax: deadline for filing a declaration

All payers of this tax must generate and submit to the tax authority a company property tax declaration. The timing of the transfer will depend on whether reporting periods for this tax are established by the provisions of regional legislation. If reporting periods are defined, at the end of each of them, but no later than the 30th day of the month, you will need to submit an advance payment calculation to the Federal Tax Service. As for the tax return for the annual period, it must be submitted by March 30. the year following the end of the tax period.

Declaration on property tax of organizations

The tax report form has been developed and approved by tax control authorities. However, this form is periodically adjusted and modified. Companies that are payers of property tax in 2017 must use the new sample report approved by Order of the Federal Tax Service No. ММВ-7-21/271 dated March 31, 2017.

The tax return consists of the following elements:

The title page, which discloses information about the taxpayer organization, such as name, INN and KPP, adjustment number, period of preparation, tax authority code, information about the person who submitted the report to the inspectorate;

Section No. 1 – reflects the amount of tax to be transferred to the treasury;

Section No. 2 - determine the basis for calculating the tax;

Section No. 2.1 – discloses information about real estate for which tax is calculated at the average annual cost;

Section No. 3 – determines the amount of tax in relation to real estate, the base for which is determined based on the cadastral value of the object.

There are several ways to submit a tax report to the Federal Tax Service. This can be done both on paper and using electronic communication channels. If the report is submitted to the fiscal control authorities on paper during a personal visit or by using postal services. By connecting electronic document management with the tax authority, the company has the opportunity to send reports in electronic format.

However, in certain situations prescribed in Art. 80 of the Tax Code of the Russian Federation, there is a direct requirement for organizations to submit tax returns only in electronic format. Such cases include:

- If the company’s average headcount for the previous year exceeded one hundred employees;

- For new, only registered companies with more than one hundred employees.

There are many questions regarding corporate property tax (zero declaration), namely, whether there is a need for companies to generate and submit a zero report form to the tax authorities.

If the company owns only property that is preferential, the tax payable will be zero. In this case, you will need to submit a zero tax return.

Also, a zero report is drawn up if the organization’s property is fully depreciated and, as a result, its residual value is zero. In this situation, it is also necessary to generate and provide inspectors with a report with zero values.